Alberta Carbon Pricing - Competitiveness Protection Measures for Industry

The Carbon Competitiveness Incentive Regulation (CCIR) [1], which replaced the Specified Gas Emitters Regulation (SGER) on January 1, 2018, is the primary mechanism for mandating greenhouse gas (GHG) emissions reductions for large industrial facilities under the Alberta Climate Leadership Plan (ACLP). The CCIR recently provided details on measures that would help limit competitiveness impacts to industry. Such measures are an important component of any carbon pricing regime because failure to reduce adverse competitiveness may result in “carbon leakage”. Carbon leakage refers to the situation of businesses relocating their production facilities to other countries that have less stringent climate policies to save money, thus putting businesses that stay put and face compliance challenges head on at a competitive disadvantage. This can also lead to a net increase in total global emissions. Mitigating carbon leakage is important – not only for address global GHG emissions, but it can also have a negative impact on local economies and government revenues.

The focus of this analysis is to provide an overview of how competitiveness exposure is defined and what competitiveness protection measures are used for large emitting facilities subject to Alberta’s CCIR.

How is competitiveness exposure defined?

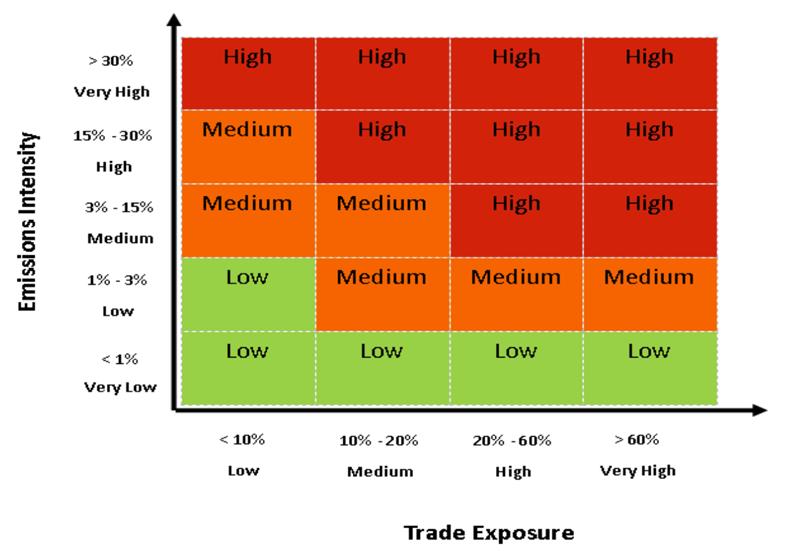

Competitiveness exposure is considered in the assessment of whether or not a sector is emissions-intensive and trade-exposed (EITE) under the Standard for Establishing and Assigning Benchmarks [2]. EITE is evaluated at the sector-level using the North American Industry Classification System. Sectors are determined to be high, medium, or low EITE according to the thresholds set out in Figure 1.

Figure 1 - Under Alberta’s CCIR the economic risk of a sector is determined according to its emissions-intensiveness and trade exposure [3].

The emissions intensity is calculated by taking the full carbon pricing costs of the sector divided by the gross value added for the sector. The full carbon pricing cost is found by multiplying the carbon price for large emitters by the total direct emissions under the previous SGER regime. Currently, the carbon price for large emitters is set at CAD $30 per tonne of carbon dioxide equivalent. The emissions intensity will be reassessed as part of the regulatory review as the carbon price changes. The first regulatory review will take place in 2020. Trade exposure is defined as the ratio of net exports to net production for end products produced by the sector (adjusted for the impact of imports).

What are the competitiveness protection measures?

Temporary exemptions for oil and gas facilities

The ACLP employs two carbon pricing mechanisms: 1) a carbon levy is imposed on all carbon-based fuels and is generally payable by fuel producers or distributors with costs typically being passed-through to end-users; and 2) an Output-based Allocation (OBA) for industrial facilities with emissions exceeding 100,000 tonnes of carbon dioxide equivalent per year. The carbon levy allows for several exemptions including natural gas produced and consumed on site by conventional oil and gas producers. Oil and gas producers are automatically exempted until January 1, 2023 as the regulator focuses in the near-term focus on reducing methane emissions from these facilities by 45% by 2025 relative to 2014 levels [4]. However, the competitive benefits may be limited as methane mitigation activities are expected to come at significant cost to industry [5] totaling CAD $780MM from 2018-2025 [6].

Output-based Allocation (OBA)

Large industrial facilities with annual emissions exceeding 100,000 tonnes of carbon dioxide equivalent per year are exempt from the carbon levy. These facilities are instead subject to an output-based carbon pricing system under the CCIR. The stringency of the OBA is derived from analysis of the competiveness exposure of a sector and sets out the number of free emissions allocations granted to a facility.

For sectors that are high or very high EITE, the benchmark stringency is adjusted based on the economic impacts. The economic impact assessment compares the SGER cost in 2015 to the incremental cost impact under CCIR. If incremental CCIR compliance costs exceed 3% of sales for more than 10% of facilities or 10% of profits for more than 25% of facilities, the benchmark is revised downward. If these conditions are met, the benchmark stringency is then adjusted from a starting point of 80% production-weighted average, up to 100% production-weighted average. In other words, most sectors will be granted free allocations for 80% of their emissions while for others free allocations could be as high as 100%.

The stringency of the benchmark is scheduled to increase in order to encourage investment in emissions reduction technology. A tightening rate of 1% annually begins in 2020. Prior to the application of a benchmark tightening rate, facilities are provided a transitional allocation benchmark so that the total compliance costs are reduced by 50% in 2018 and by 25% in 2019. This phase-in period gives facilities time to make improvements before full compliance costs are enforced in 2020.

While the CCIR applies to large industrial facilities, smaller facilities seeking relief from the full impact of the carbon levy can opt-in to the regulation. To opt-in, the facility must either directly compete with a facility already subject to the CCIR or be designated as EITE and have emissions greater than 50,000 tonnes of carbon dioxide equivalent per year. If an established benchmark does not already exist for the products produced, the opt-in facility must apply for an assigned benchmark.

The conventional oil and gas industry will not be permitted to opt-in or out of the CCIR due to the exemption from the levy until January 1, 2023. Beginning in 2023, it is expected that these facilities will be able to opt-in to the CCIR in order to obtain an output-based emissions allocation. This would result in lower overall compliance costs compared to paying the carbon levy.

Cost Containment Designation

The cost containment designation under CCIR is the last line of defense for individual facilities facing competitiveness issues under the CCIR. The CCIR already makes stringency adjustments to the sector-level benchmarks to account for adverse economic impacts, but this does not take into account adverse economic impacts at the facility-level. Individual facilities must first demonstrate “economic hardship” from compliance costs under the CCIR. Economic hardship can be demonstrated if facilities:

- Exhibit high or very high EITE status; and

- Incremental compliance costs exceed 3% of facility sales or 10% of facility profits

In addition to sales and profit impacts, facilities may propose alternative economic hardship tests for consideration by the regulator.

Facilities that receive a cost containment designation are first provided the option to use GHG credits the meet the facility-level compliance obligation beyond the credit usage limits that are normally applied. Second, if the facility still demonstrates economic hardship, the facility is provided funding through an Industrial Energy Efficiency grant or other program grants. Finally, if after applying the first two mechanisms the facility still demonstrates economic hardship, a compliance cost containment allocation benchmark for the facility may be assigned. This would be less stringent than the benchmark applied to other facilities in the sector.

It should be noted that if operators are considering applying for the cost containment designation, they will incur additional validation and auditing obligations. In addition, the facility receiving cost containment support must submit an annual report that outlines an emissions reduction plan that sets out how the facility will reduce emissions so that it is no longer likely to experience economic hardship from incremental compliance costs. These additional administrative costs should be considered when assessing the benefits of cost containment. The cost containment designation is only in effect until the end of 2022. Beginning in 2023, the facility will face the full compliance costs under the CCIR carbon pricing program.

Conclusion

Many regulated entities may be left questioning whether or not these competitiveness protection measures are sufficient. Alberta is already ranked low compared to other jurisdictions for investment attractiveness in the oil and gas sector [7] and has recently experienced steep declines in investment [8]. The Canadian Association of Petroleum Producers estimate that total capital spending in 2017 was $45 billion – a 44 per cent decline compared to $81 billion in 2014 while capital spending in the U.S. rose about 38 per cent to $120 billion in 2017 [9]. However, while carbon pricing is one factor that imposes cost on industry, market access dominates as the single largest competitiveness factor in Alberta’s oil and gas sector [10]. Regardless of the sufficiency of the competitiveness protection measures, operators should assess the tools that are available. Large emitting facilities that successfully demonstrate “economic hardship” could generate millions of dollars in annual GHG compliance savings. If you think that your facility is a candidate for cost containment under the CCIR, we have experts that can assist in

- Facility screening and preliminary regulatory exposure to existing and future carbon pricing regulations;

- Emissions quantification, reporting, and compliance optimization under the CCIR; and

- Cost containment designation application development and support.

There is a strong business case for understanding regulatory flexibility and investing in expertise that can advise on a short and long-term lost-cost compliance strategies.

References

- http://www.qp.alberta.ca/documents/Regs/2017_255.pdf

- https://www.alberta.ca/assets/documents/CCI-standard-establishing-assigning-benchmarks.pdf

- https://open.alberta.ca/publications/standard-for-establishing-and-assigning-benchmarks-version-2-2

- https://www.alberta.ca/climate-methane-emissions.aspx

- https://www.aer.ca/documents/DelphiAlbertaMethaneAbatementCostStudy.pdf

- https://www.aer.ca/providing-information/by-topic/methane/reports-and-studies

- https://www.fraserinstitute.org/studies/global-petroleum-survey-2017

- https://www.aer.ca/providing-information/data-and-reports/statistical-reports/capital-expenditures

- https://www.capp.ca/publications-and-statistics/economicseries

- https://www.cdhowe.org/sites/default/files/attachments/research_papers/mixed/C.D%20Howe%20Commentary%20501.pdf